Mortgage Workflow Automation

As businesses increasingly turn to automation for greater value, yet encounter challenges such as inefficient change management, unstructured data, diverse tools, and ROI concerns.

Smooth mortgage origination faces significant hurdles. Streamlining loan processing with a focus on data privacy, accuracy, and regulatory compliance is crucial. Mortgage processing automation improves efficiency by automating form routing and data handling, reducing complexity, errors, and enhancing customer experience.

Our mortgage process automation solutions provide a comprehensive support, from establishing an Automation COE to identifying optimal automation opportunities and technologies for data intake, process automation, and analytics. With our outcome-driven approach, we assist in designing robust governance structures, managing change seamlessly, and achieving transformational outcomes.

As businesses increasingly turn to automation for greater value, yet encounter challenges such as inefficient change management, unstructured data, diverse tools, and ROI concerns.

Improve efficiency. Reduce time & cost of origination. Focus your people on tasks that matter.

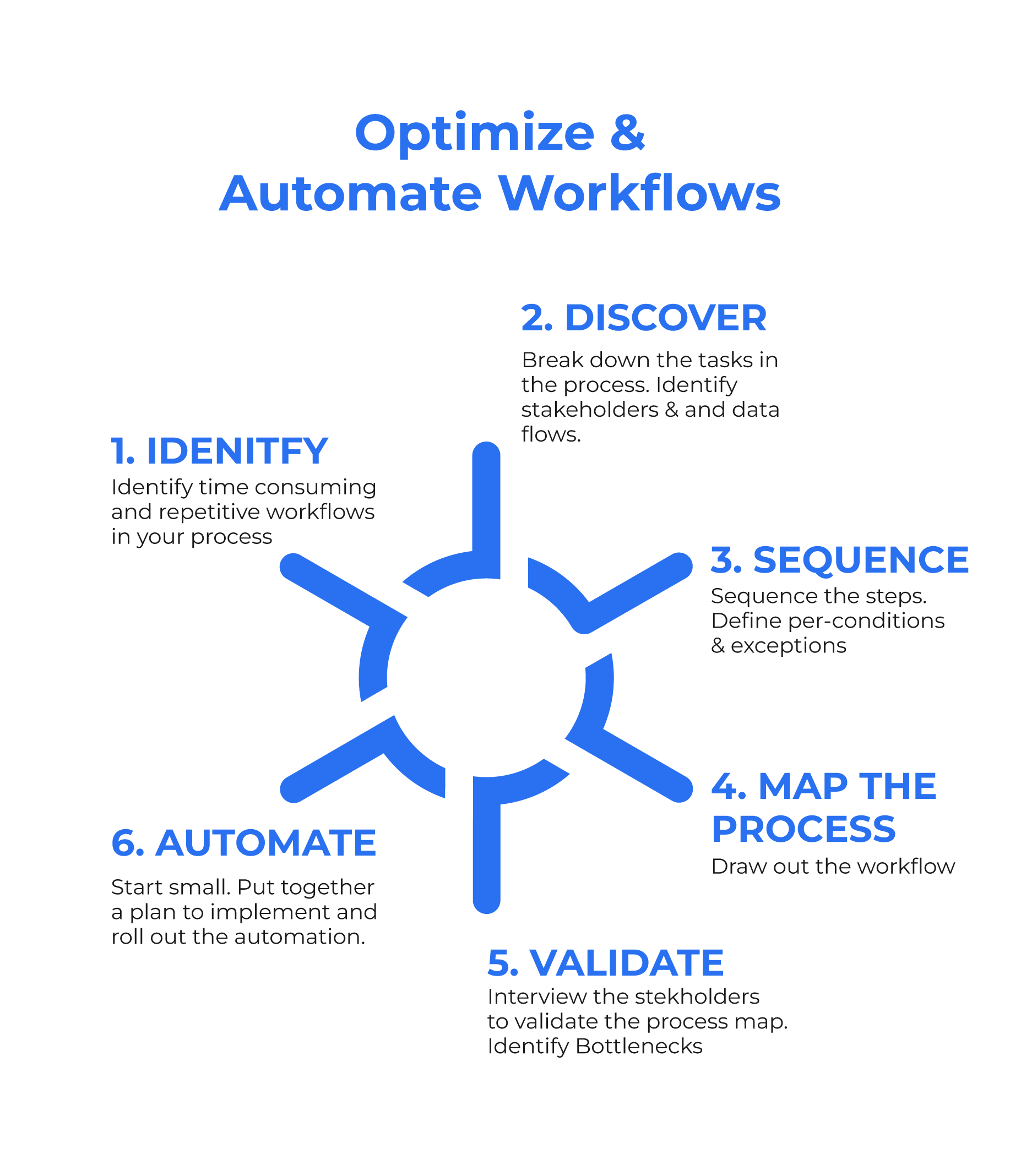

Identify time consuming and repetitive workflows in your process.

Break down the tasks, discover all stakeholders involved, the data flows, the decisions involved.

Sequence the steps. Define the pre-conditions for the process to begin, and any exceptions to the flow.

Generate a process map.

Validate this visual flow with the stakeholders. Analyze bottlenecks and determine potential opportunities for improvement.

Now that you have a great understanding of the workflow, automate the process. Start small with one workflow and put together a plan to implement & roll out the automation.

What advantages does automated mortgage processing offer?

Robotic Process Automation (RPA) has gained significant popularity in the mortgage, banking, and finance sectors for its extensive benefits across the loan lifecycle. Beyond managing loan origination tasks, RPA handles document processing, customer relations management software, accounting, regulatory compliance, cash flow processes, and more. As a result, it delivers numerous advantages.

- Reduced Processing Costs: The integration of RPA and AI enables automated mortgage processing programs like Automation Anywhere’s Document Automation to cut down on hours and processing costs. This approach prevents overburdening current employees, ensures automated handling of processes, and enhances overall company efficiency with reduced manpower.

- Better Customer and Employee Experience: Increased company efficiency leads to enhanced experiences for both employees and clients. Borrowers receive prompt, understandable responses through 24/7 automated support, ensuring access to solutions whenever required. This results in satisfied staff, satisfied customers, and overall business success.

- Eliminate Errors: Repetitive manual tasks are inherently susceptible to human errors, regardless of training or experience. Introducing a mortgage automation platform enables employees to sidestep these repetitive, error-prone tasks. This grants them the freedom to concentrate on critical actions, enhance decision-making accuracy, optimize loan portfolios, and mitigate risks effectively.

- Detect and Fight Fraud: Fraud cases have seen a significant increase. Mortgage lending RPA swiftly identifies and reduces fraud attempts, thereby minimizing losses. It serves as a reliable Loss Origination System (LOS).

- Higher Compliance:

Regulations and regulatory bodies have undergone substantial changes in recent years. Adapting to and meeting the requirements of these systems entails staying current with these updates. Mortgage processing automation facilitates the creation of audit trails to enhance compliance and improve error detection capabilities.

- Improved Forecasting and Decision Making: Automated mortgage processing enables accurate revenue and loss forecasting. With enhanced borrower databases and deeper insights, you gain the insights needed to make informed decisions about resource allocation.

Who Benefits from Mortgage Process Automation Services?

Mortgage process automation delivers extensive benefits to employees across all departments within the company. Its impact spans throughout the organization, benefiting various teams and staff members.

Management and Leadership: Mortgage process automation guarantees compliance while empowering leadership through comprehensive information and data trails. This technology enables more confident decision-making and facilitates actions previously out of reach.

Customer Service Agents: With the information and databases generated by mortgage process automation, customer service departments can promptly provide customers with answers, update records, and offer more tailored product recommendations based on existing customer data.

Sales and Marketing Teams: Armed with comprehensive insights into client product holdings and enhanced risk assessments, sales and marketing teams can significantly enhance their effectiveness. They can refine marketing strategies for greater impact, while sales teams can adeptly upsell and identify products that would benefit clients.

Accounting and Finance Departments: Mortgage process automation establishes clear information trails that demonstrate compliance and adherence to evolving rules and regulations. In case of regulatory changes, adjustments and requests for any missing information or documentation are swiftly managed.

Go beyond your dreams

Taliun has deep expertise in mortgage lending. We are experts in LOS solutions like Encompass and have the technical expertise to leverage APIs and RPA tools to automate your workflow. Click here to schedule an initial consultation call

We want to hear from you

Send us your details and we’ll get back to you to schedule a time to talk.